Mockup generated with AI (MidJourney + Photoshop)

The challenge

In 2021, Zertiban was founded with a clear mission: to merge digital signature capabilities with payment solutions.

As a licensed Payment Entity by the Banco de España, Zertiban aims to leverage user identification through online banking for both signature authentication and payment initiation services. This approach takes full advantage of both PSD2 and eIDAS regulations set by the EU.

As the first designer in the company, I faced the challenge to build from the ground up a platform that could facilitate sign-and-pay requests efficiently while ensuring high security and regulatory compliance.

In addition, I developed the initial version of Zertiban's visual identity. Taking inspiration from the simple and harmonious silhouette of a credit card, I created an icon that represents the alignment between trusted services and payment entities in a Z-shaped composition.

Design process

At Zertiban, our design journey starts with an in-depth UX research phase to fully understand the needs of the newly requested service. After gaining both internal and external insights, we draft a Product Requirements Document (PRD) that specifies the new service or functionality.

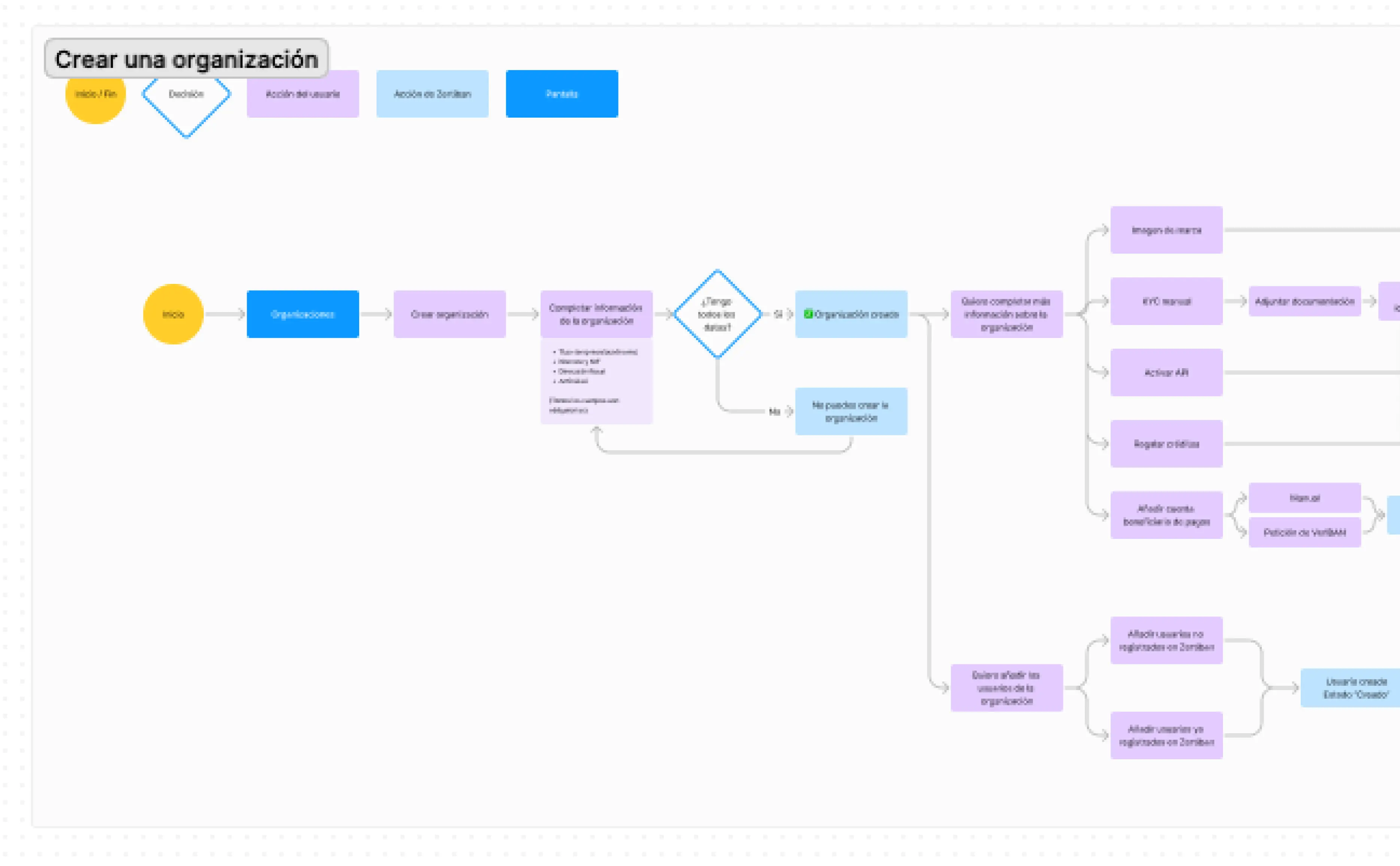

Next, we create user flow and information architecture diagrams to map out the service's user experience and its impact on the overall product. Working closely with the engineering team, we assist in designing the necessary API endpoints, ensuring the new service is accessible via our dashboard and directly through the API.

The process also includes validation milestones with the management team, ensuring alignment with business goals. The design is then uplifted to high definition using our design system. Once it’s developed and deployed in our sandbox, we conduct a design QA phase before the final launch.

A dashboard to manage your signatures and payments

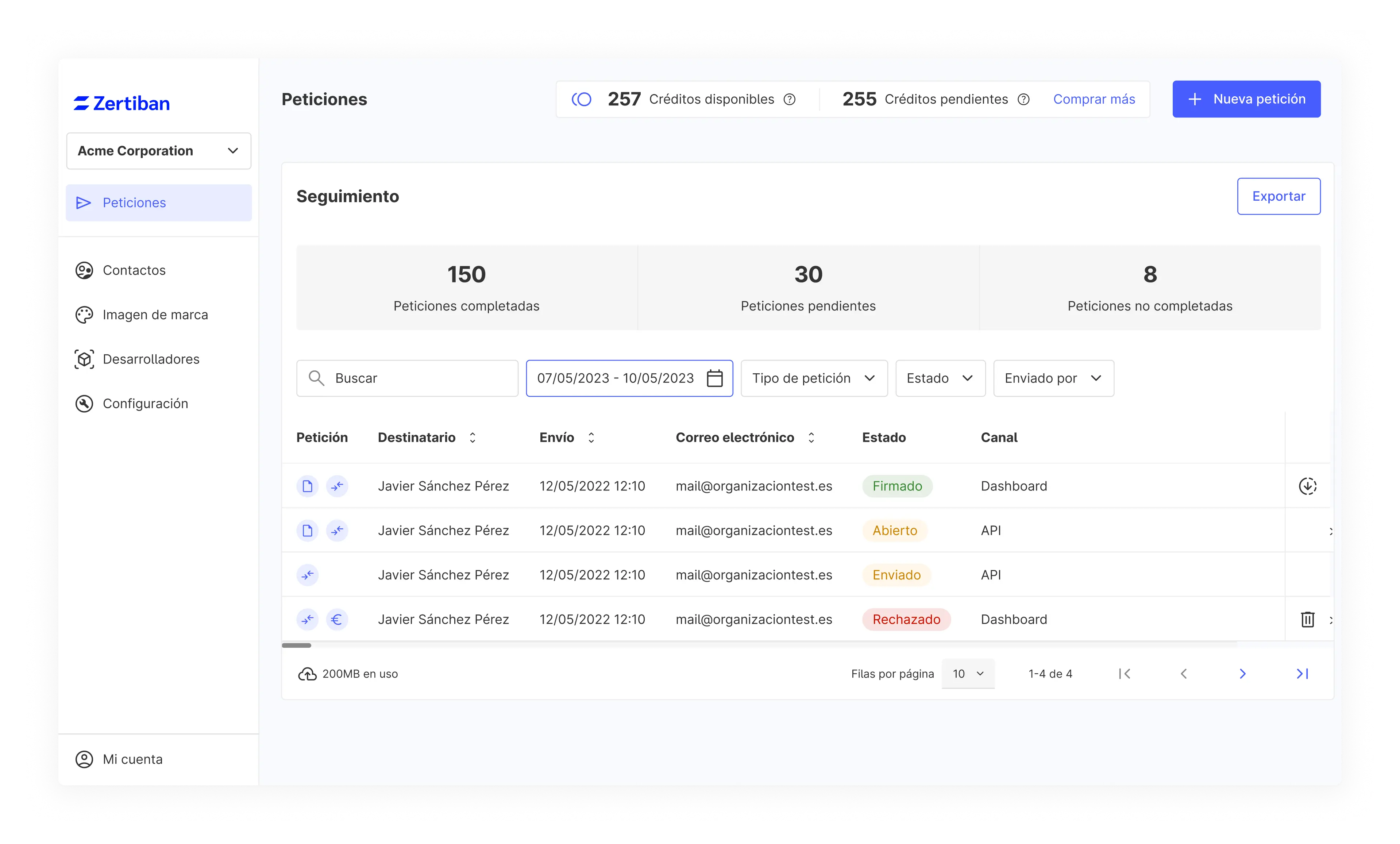

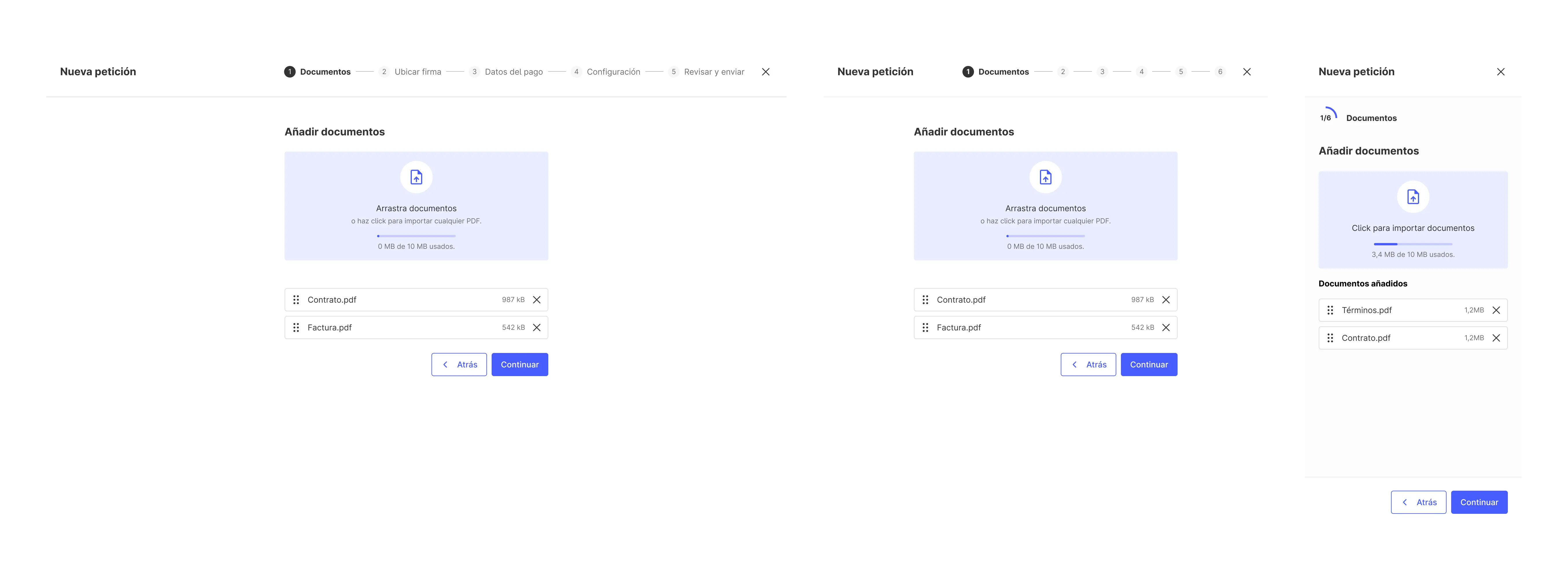

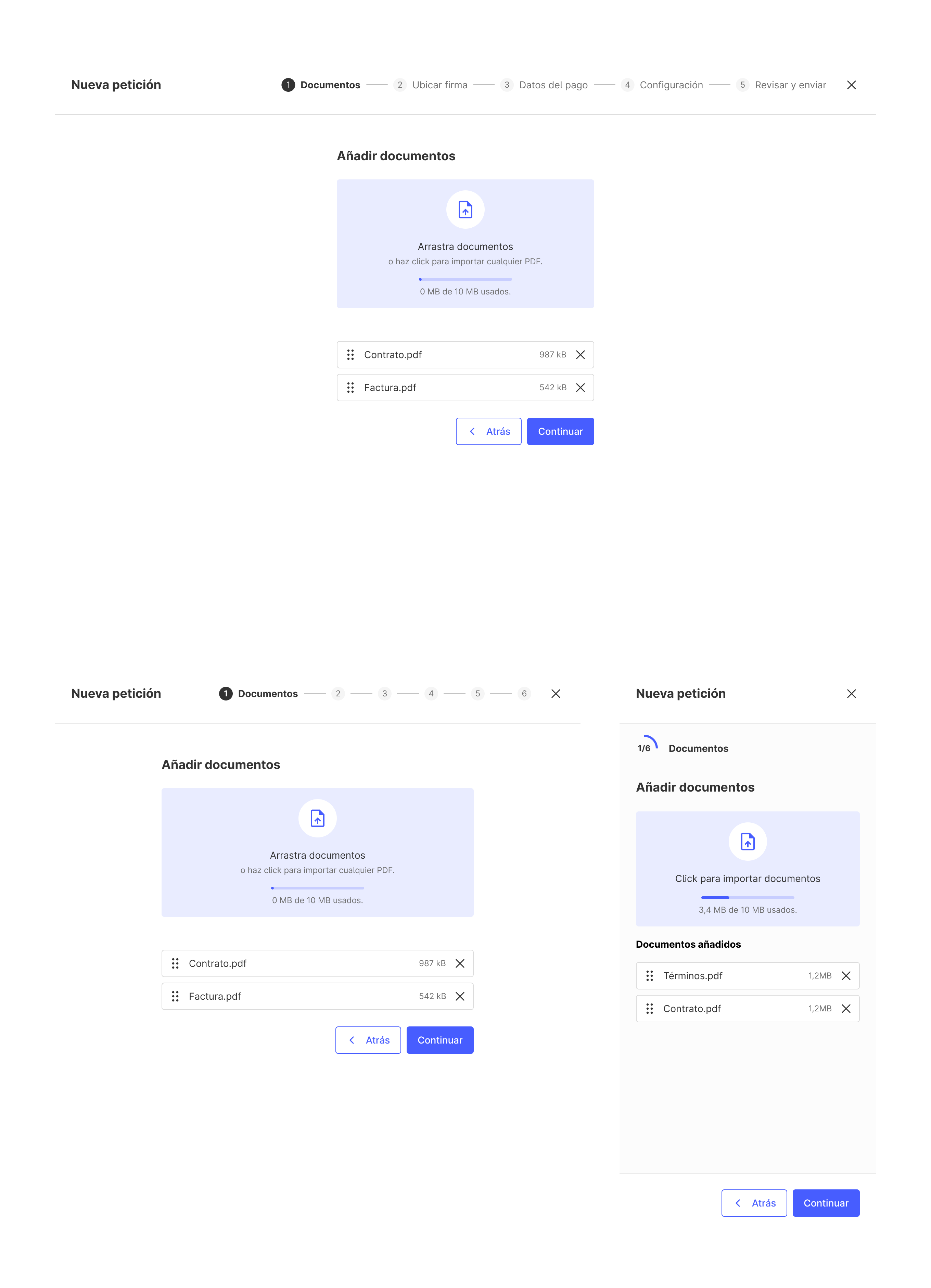

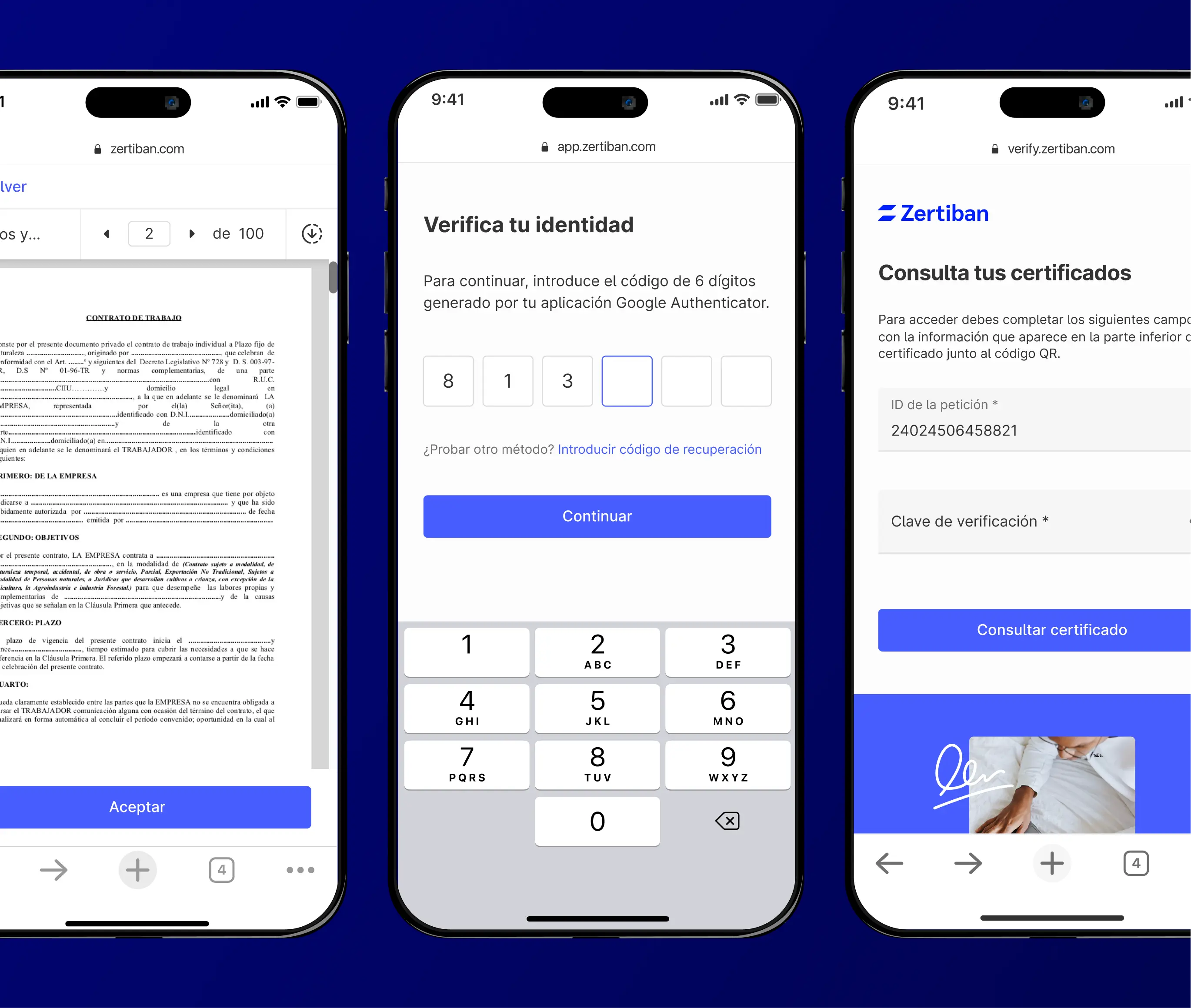

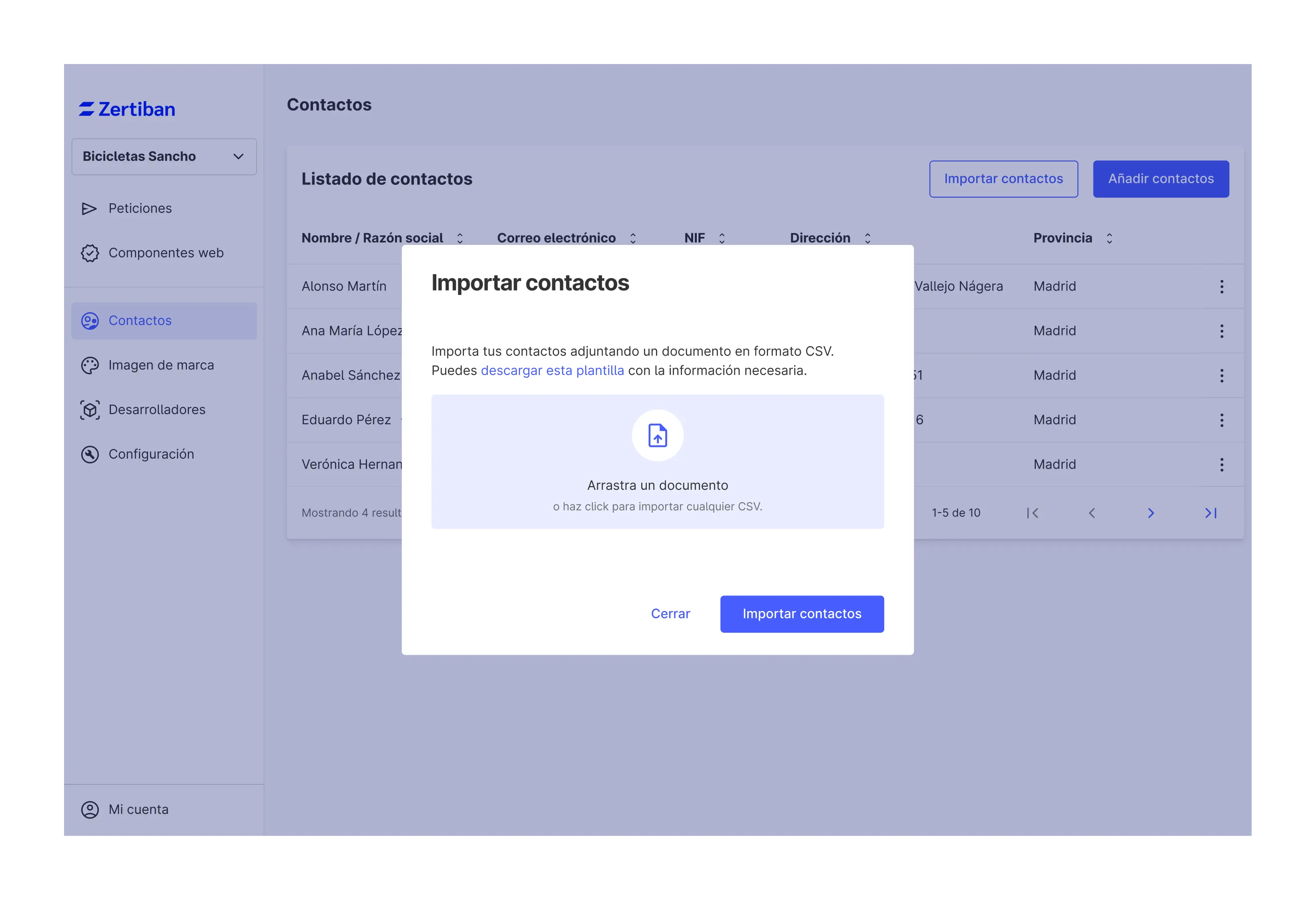

The Zertiban dashboard was crafted with the main objective of enabling users to send sign-and-pay requests effortlessly.

A crucial component of the platform is the Know Your Customer (KYC) process, designed to authenticate users intending to request payments. The dashboard also incorporates features to enhance productivity, such as tracking request updates, configuring default settings and storing client information for future transactions.

We also introduced several key features, such as login and sign-up processes, an interactive onboarding tour to guide new users, team management tools and organization and user account settings.