Concept and innovation

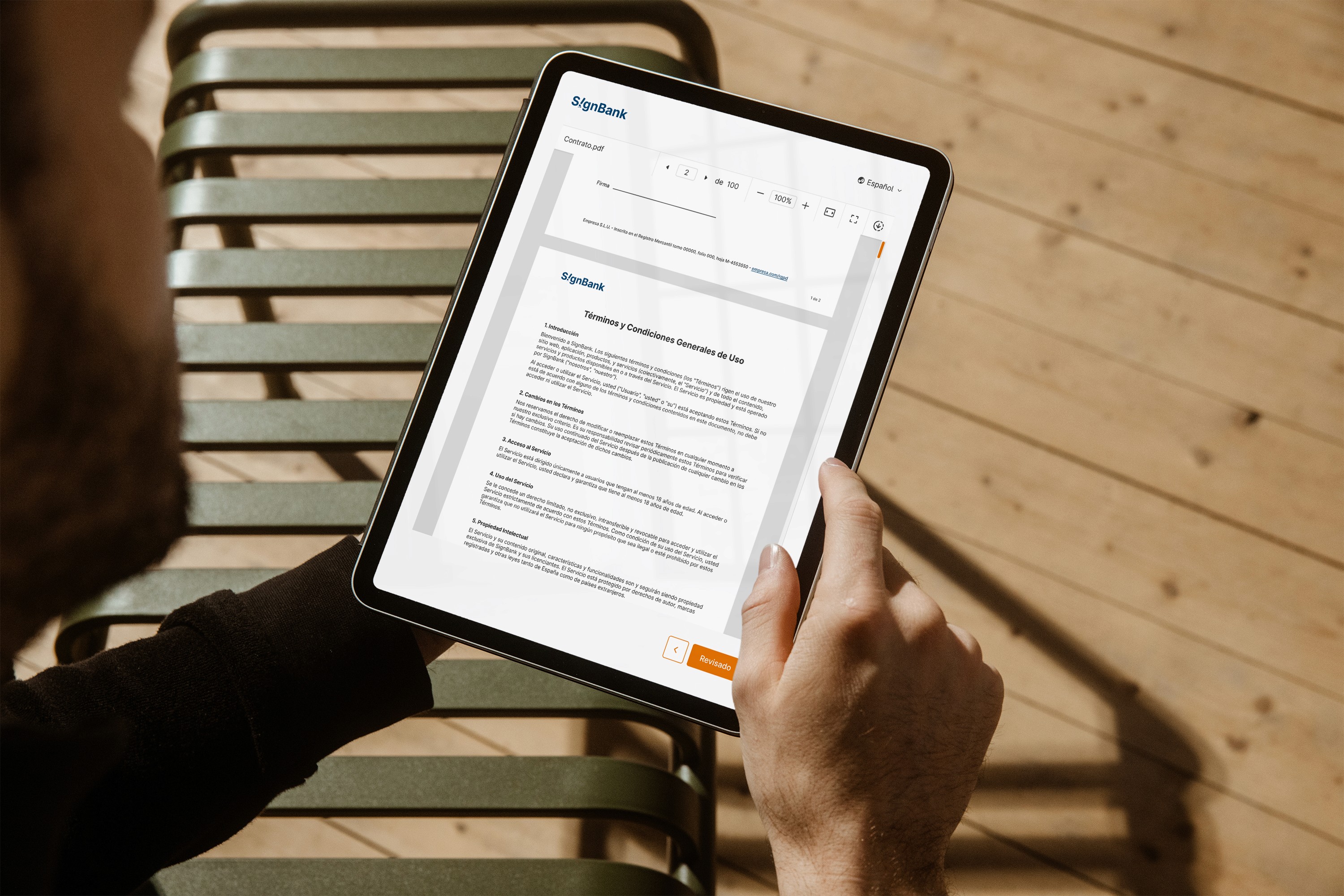

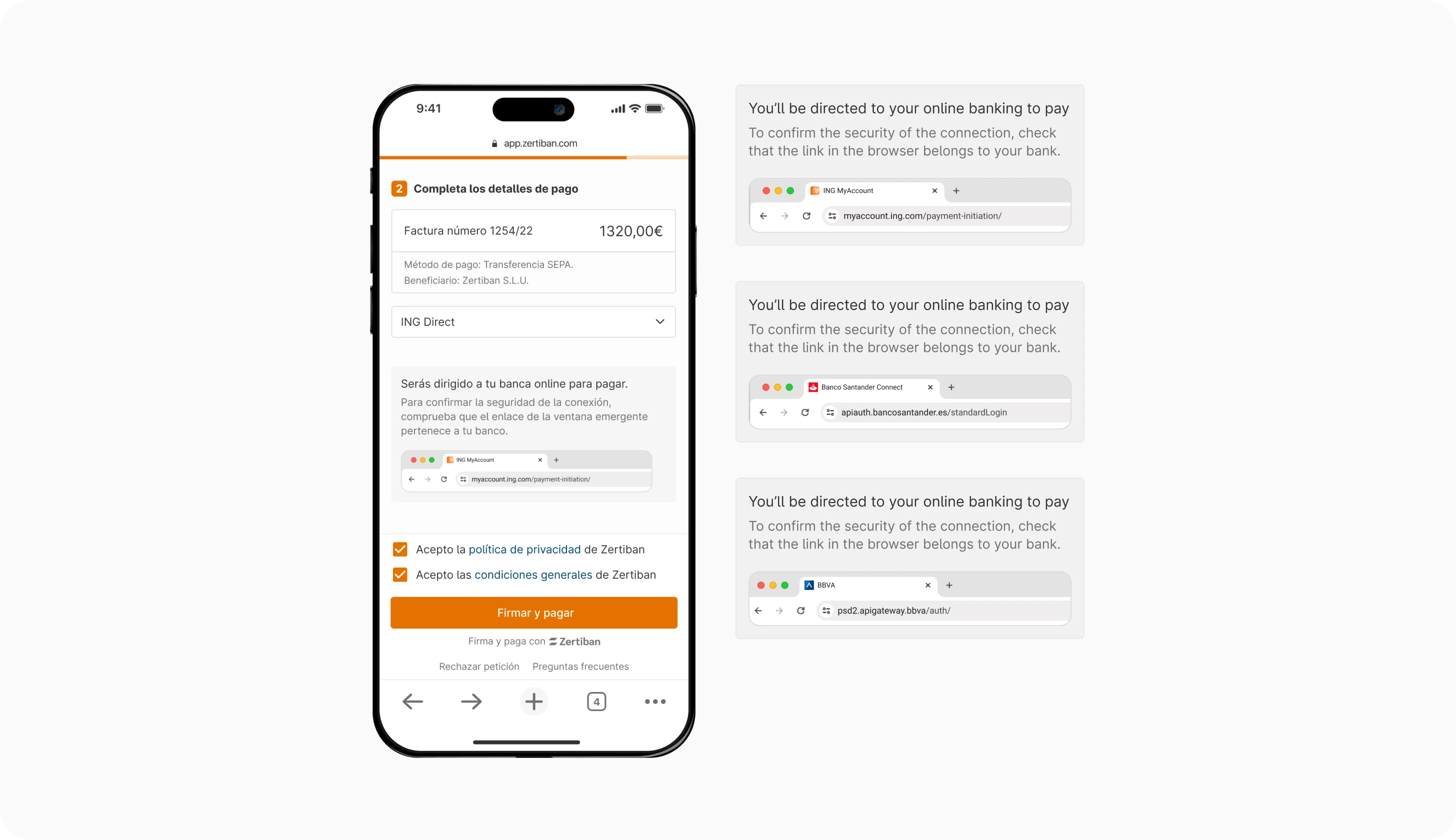

Zertiban, a startup focused in the intersection of digital signatures and payments, needed a gateway where users could sign documents and authorize a payment just logging into their online banking. As the lead designer at Zertiban, I was involved from the initial discovery stage to the its launch.

The resulting solution lets users sign documents and complete a related payment in under a minute, as shown in the video below.

Sign and pay in one step

The approach followed Zertiban’s design process. The journey involved close collaboration with Zertiban’s Legal team and external consultants to find a sweet spot between usability and compliance.

We carried out dozens of prototypes to explore and validate our proposals. During the process, we leaned towards a mobile-first approach and conducted several user testing exercises with friends & family and early clients. Their feedback was key in shaping a more intuitive platform and enhancing users' sense of security.

Alternative use cases

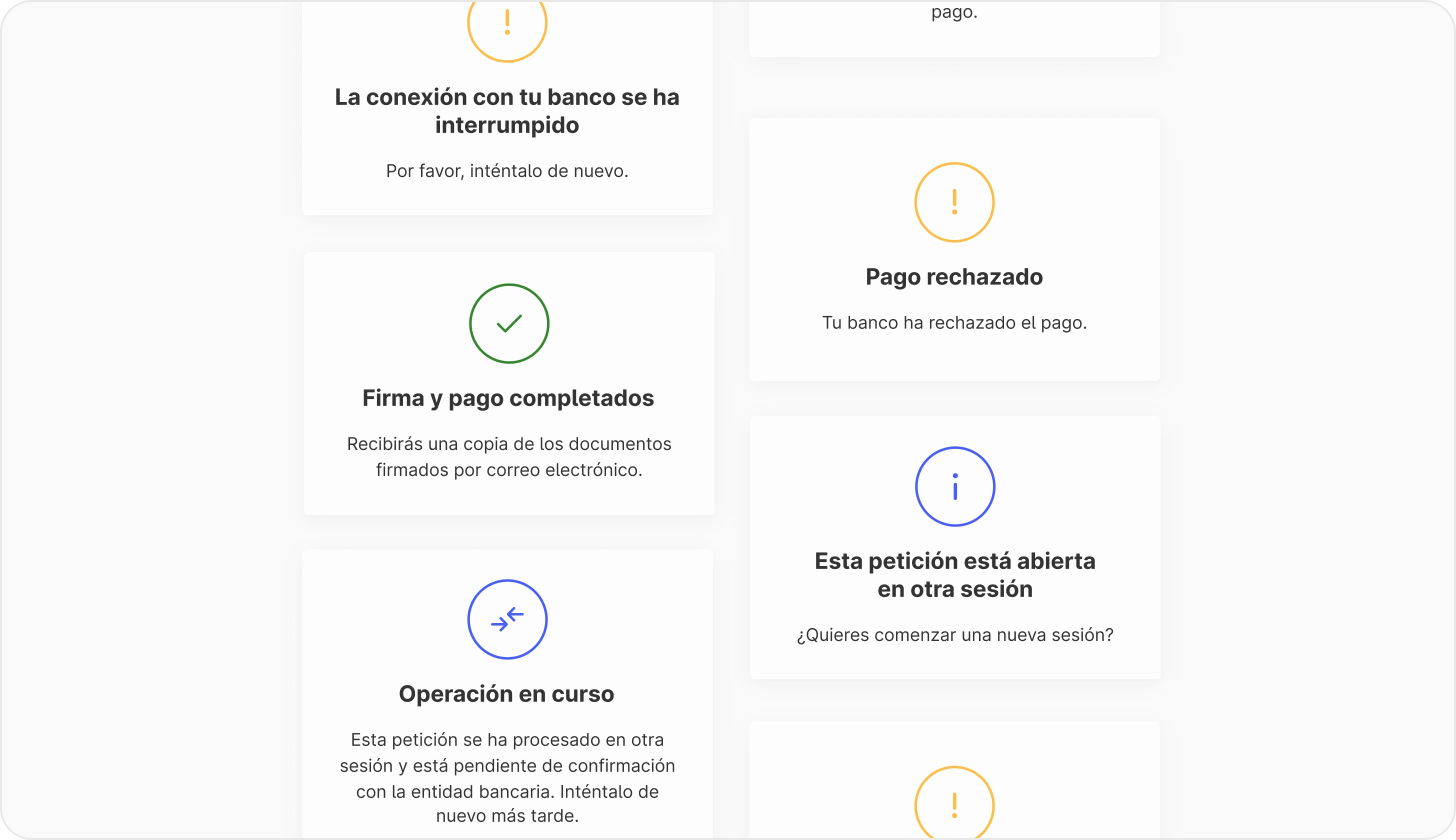

During the sign-and-pay process, there could be various errors, from issues within Zertiban’s services to connections with banks or other providers.Collaborating with back-end developers expert in PSD2, we conducted a deep research and documented potential issues. Then, we crafted tailored error messages to accurately inform users about the situation and how to proceed.

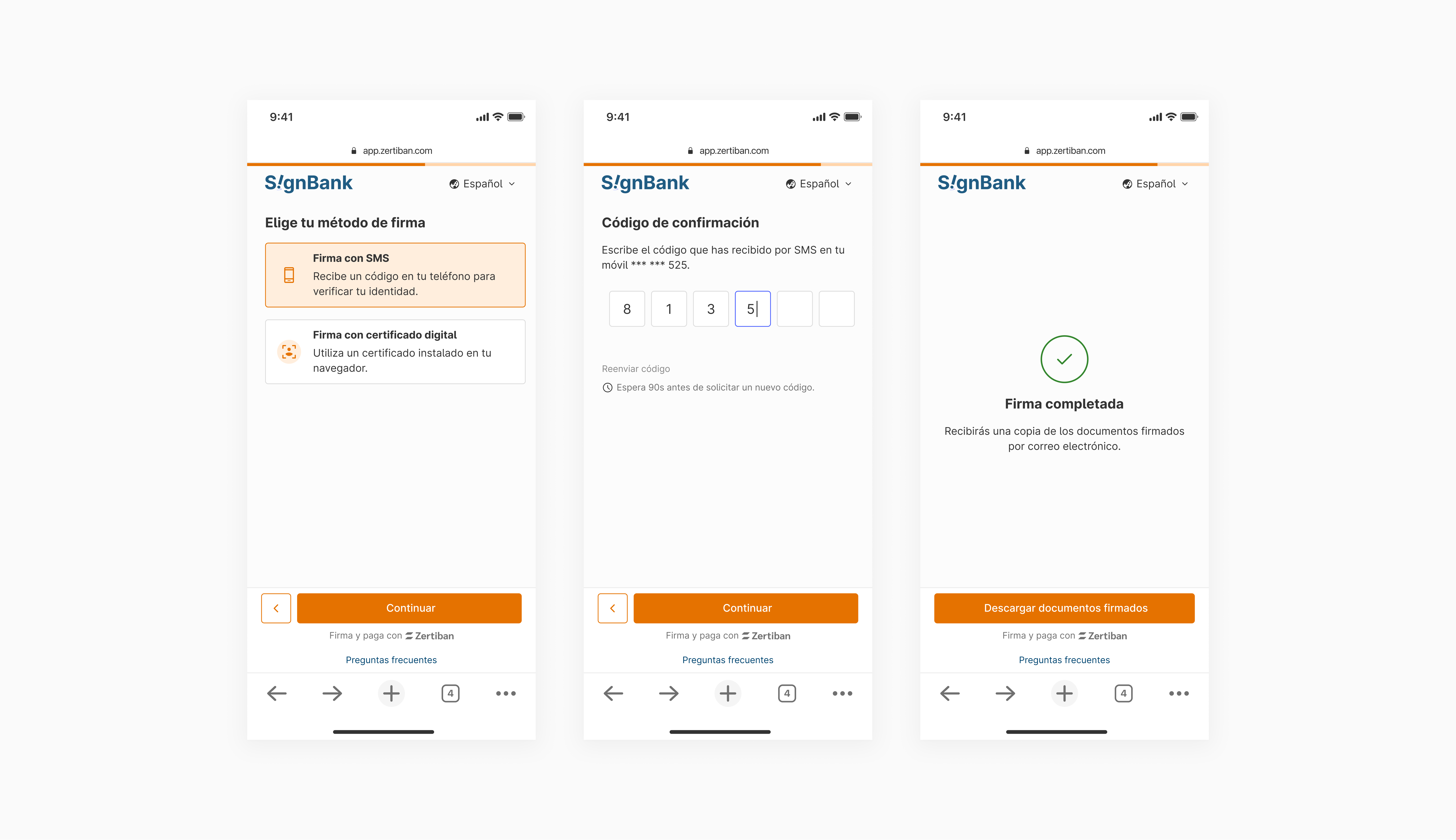

On the other hand, Zertiban collaborates with major Spanish banks, serving 90% of online banking users. For those whose banks are not yet integrated, we've implemented a failover system. This includes options for identification such as SMS and digital certificates, ensuring the documents can be signed.